MSME, which stands for Micro, Small, and Medium Enterprises, serve as a collective term encompassing all businesses with investments totalling less than INR 1 crore or annual turnovers below INR 5 crores. Micro enterprises often operate with minimal or no external support and may not prioritize revenue generation. The proliferation of digital technology has had a profound impact across various sectors, necessitating even small-scale businesses to embrace digital technology effectively to establish a foothold in today's competitive marketplace.

Pay10 provides MSMEs with effective, dependable, and adaptable solutions tailored to their specific needs. The emergence of FinTech brings digital payment technology to micro, small, and medium-sized enterprises, allowing them to actively participate in the digital age. As a small business owner, you don't have to become a FinTech expert with technical expertise to modernize your business digitally, just choose the best payment gateway in India, that can allow to you delve into the market without much in-depth knowledge. Here are 7 simple preliminary checks every small business owner needs to know, before setting up a Digital Payment Platform.

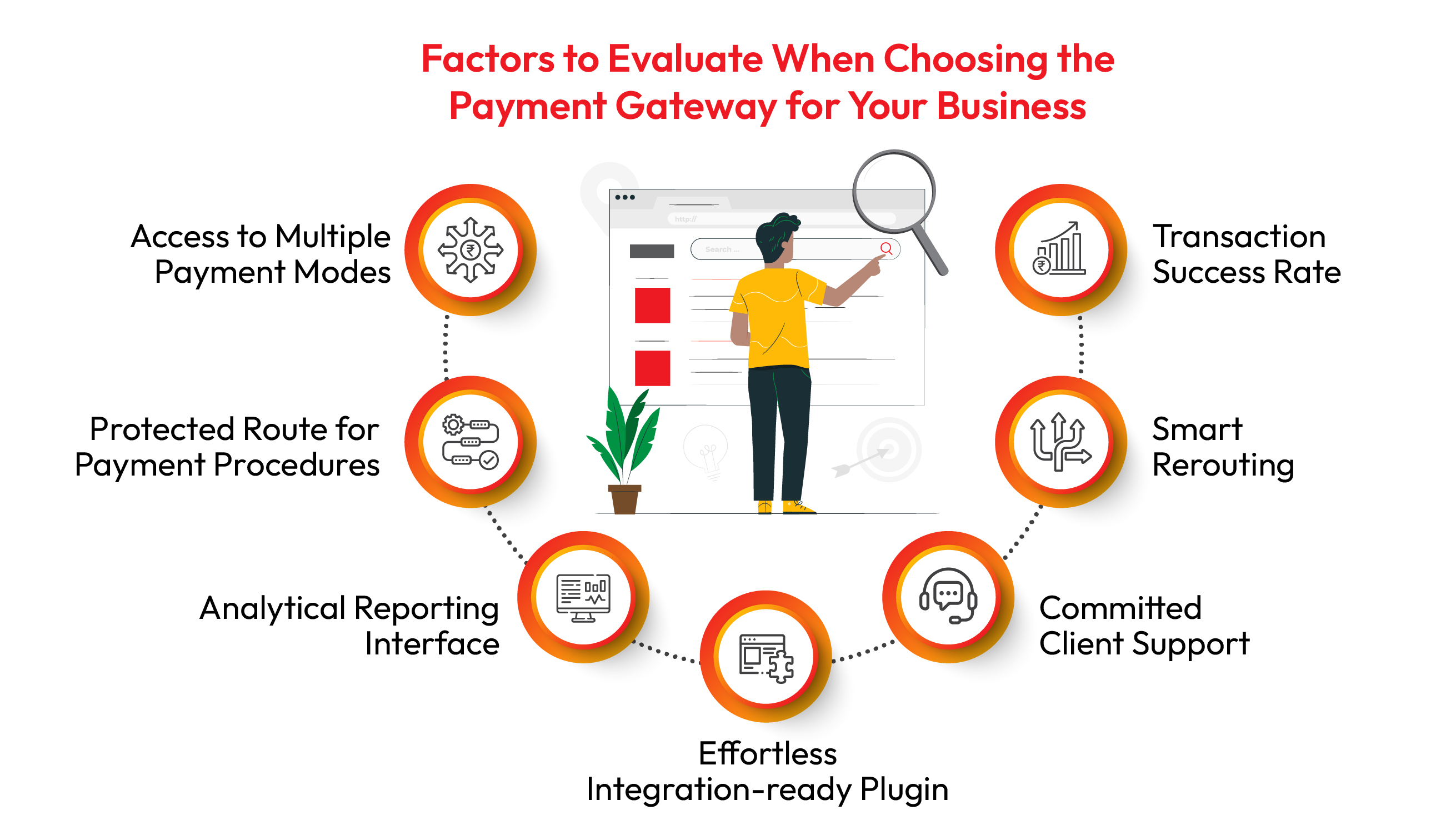

Features to Consider Before Selecting the Payment Gateway For Business

1. Access to Multiple Payment modes

For a small business owner, when selecting a Payment Gateway, checking available payment options is a pre-requisite. Over the years, FinTech services have come up with a variety of payment modes capturing the fleeting attention of consumers and adding convenience to their experience. While picking a payment gateway for your organisation make sure that the payment gateway offers a multitude of payment options including credit/debit cards, internet banking, UPI, wallets and other numerous options.

2. Protected Route for Payment Procedures

A small business owner must prioritize and safeguard customers' payment information, both at rest and during transmission. One crucial factor to consider when selecting a secure payment gateway provider in India for handling your payment transactions is the presence of PCI-DSS Level 1 Certification. Ensure that all security protocols are robustly implemented, with rigorous checkpoints, and stringent in-house policies.

3. Analytical Reporting Interface

The Payment Gateway you select should have a secure infrastructure and provide an intuitive analytical dashboard that goes beyond mere payment tracking. This user-friendly analytical dashboard should be capable of generating valuable insights to support crucial business decisions aimed at enhancing revenue generation and improving ROI

4. Effortless Integration-ready Plugin

Seamless integration through an Application Programming Interface (API) is a crucial factor when considering FinTech services. A smooth onboarding process, featuring clean and hassle-free integration compatible with multiple platforms, not only conserves time and resources but also ensures swift implementation and user-friendliness. Furthermore, a cloud-based infrastructure offers enhanced scalability, which is particularly advantageous for small businesses

5. Committed Client Support

The Payment Gateway you opt for should provide specialized customer support services and promise efficient conflict resolution with a minimal Turn Around Time (TAT). Make sure to select the best Payment solution Provider for your business, committed to delivering dedicated customer support adhering to established procedures, and ensuring prompt payment settlements. Having dedicated customer support from your Payment Service Provider not only simplifies payment issue resolution but also enhances customer satisfaction.

6. Smart Rerouting

A smart routing system grants access to various payment gateways and efficiently directs payments to the most suitable option. This proves advantageous for businesses with extensive geographical reach and those experiencing rapid growth. Smart routing systems analyze factors such as geographical location, payment methods, and currencies to identify the most fitting gateway.

7. Transaction Success Rate

Transaction Success Rate is an important parameter for assessing the effectiveness of a Payment Gateway. This metric signifies the percentage of customer-initiated payment attempts that the Payment Gateway successfully processes. A high Transaction Success Rate significantly reduces cart abandonment, ensuring a seamless payment experience for your customers and contributing positively to their overall satisfaction."

What makes Pay 10 the best payment gateway provider in India?

Pay10 stands out as the premier payment gateway in India for a multitude of compelling reasons. As a pioneering force in the industry, we are dedicated to delivering versatile online payment solutions that are marked by innovation and exceptional efficiency. What sets us a part is our comprehensive range of offerings, which includes ready-to-use plugins and a seamless digital transaction experience for merchants, issuers, and network operators. We believe in democratizing access to digital payment solutions, and empowering businesses across all sectors and sizes. Whether you need a secure payment gateway, e-payment wallets, e-commerce services, online remittance, or merchant accounts, Pay10 has you covered. Our ultra-efficient payment platform adheres to strict standards, holding certifications such as PCI-DSS Level 1, SAR (PAPG & Data localization), VSCC, ISO 9001:2015, and 27001:2013. Additionally, our data is hosted on trusted cloud service providers like AWS (Amazon Web Services), ensuring top-notch data security.

FAQ

- Q1. What is TSR?

The Transaction Success Rate is the percentage of payment attempts that result in a successful

transfer of funds

- Q2. What makes Pay10 the best payment solution provider in India?

Pay10 is the leading payment gateway rendering multifaceted online payment solutions with an

innovative and ultra-proficient approach. Our ultra-efficient payment platform adheres to strict

standards, holding certifications such as PCI-DSS Level 1, SAR (PAPG & Data localization), VSCC,

ISO 9001:2015, and 27001:2013. Additionally, our data is hosted on trusted cloud service providers

like AWS (Amazon Web Services), ensuring top-notch data security.

- Q3. Is it risky to integrate a payment gateway with my business?

Payment gateways process sensitive financial information, making them attractive targets

for cybercriminals. Ensure that your payment gateway provider complies with security standards

like PCI DSS (Payment Card Industry Data Security Standard). Implement strong encryption, regularly

update software, and monitor for suspicious activity.