A Comprehensive Guide to understanding AePS

Aadhaar Enabled Payment System (AePS) is a key Payment Instrument to help mobilize Financial Inclusion in India. The numerous Digital Payment Channels readily available in Tier-1 & Tier-2 cities are not easily accessible for the rural demographic of a deeply agrarian country. The acute resource gap between different demographics can only be bridged by innovative FinTech products that are designed to address specific challenges faced by certain demographics, employing existing assets.

According to Statista, the internet usage in India witnessed a meteoric rise accelerated by the Covid-19 pandemic, with 658 million users i.e., 47% of the total population in 2022. Internet penetration in rural India is progressing at a much slower pace compared to their urban counterparts, given the infrastructure limitations and various impactful factors. To further accelerate the use of Digital Payments in Rural India, Reserve Bank of India (RBI) and NPCI introduced several innovative and inclusive FinTech services, Aadhaar enabled Payment System (AePS) being one of the key digital payment initiatives.

What is AePS?

AePS full form is Aadhaar Enabled Payment Service, developed by National Payments Corporation of India (NPCI) aims to facilitate financial transaction using Aadhaar number. Aadhaar number is an extensively used instrument of identification in India and introduction of a digital payment system using the same is intended to have better reach in tier-3 & 4 cities.

Purpose of AePS

Although presence of an ATM is indisputably prominent in Tier 1 cities, the distribution of ATMs within the rest of the country is uneven. Deccan Herald (Feb 23) reported metro cities in India have 53 ATMs per 1 Lakh population while rural areas have meagre 9 ATMs per 1 Lakh population. According to the World Bank statistics, rural population account to nearly 65% of total population of India. It is quite apparent that a majority of the country’s vast population finds it challenging to access ATMs.

While installation and maintenance of a fully operational ATM poses several logistical challenges when serving rural India. Micro-ATMs are a low-cost, flexible alternatives for ATMs. They have gained much traction with ease of use, reduced logistical challenges, and increased potential for market penetration. AePS platform offers Business Correspondents or merchants (Retail outlets, Kirana stores, etc.) to provide basic banking services to their customers.

Features of AePS

Aadhaar enabled Payment Service enables Business Correspondents or merchants to offer the following services to their customers.

In addition to the remote location banking service access that includes money transfer to remote location, balance enquiry in remote locations, cash withdrawal through business correspondent, cash deposit through business correspondent Micro ATM, the AePS facility can also be used for the following banking requirements.

- Aadhaar to Aadhaar fund transfer

- Generating Mini Statement

- Cashless Merchant Payments with BHIM Aadhaar Pay

- Self Help Group (SHG) Banking

What is required to use AePS facility?

Aadhaar enabled Payment Service (AePS) functions with very minimum requirements. A business correspondent or merchant only needs two things to offer AePS services to their customers.

- Micro ATM

- Biometric device

The customer only needs to know the Aadhaar number to access banking services. An Aadhaar card linked with the Bank Account is the only requirement to access all AePS features.

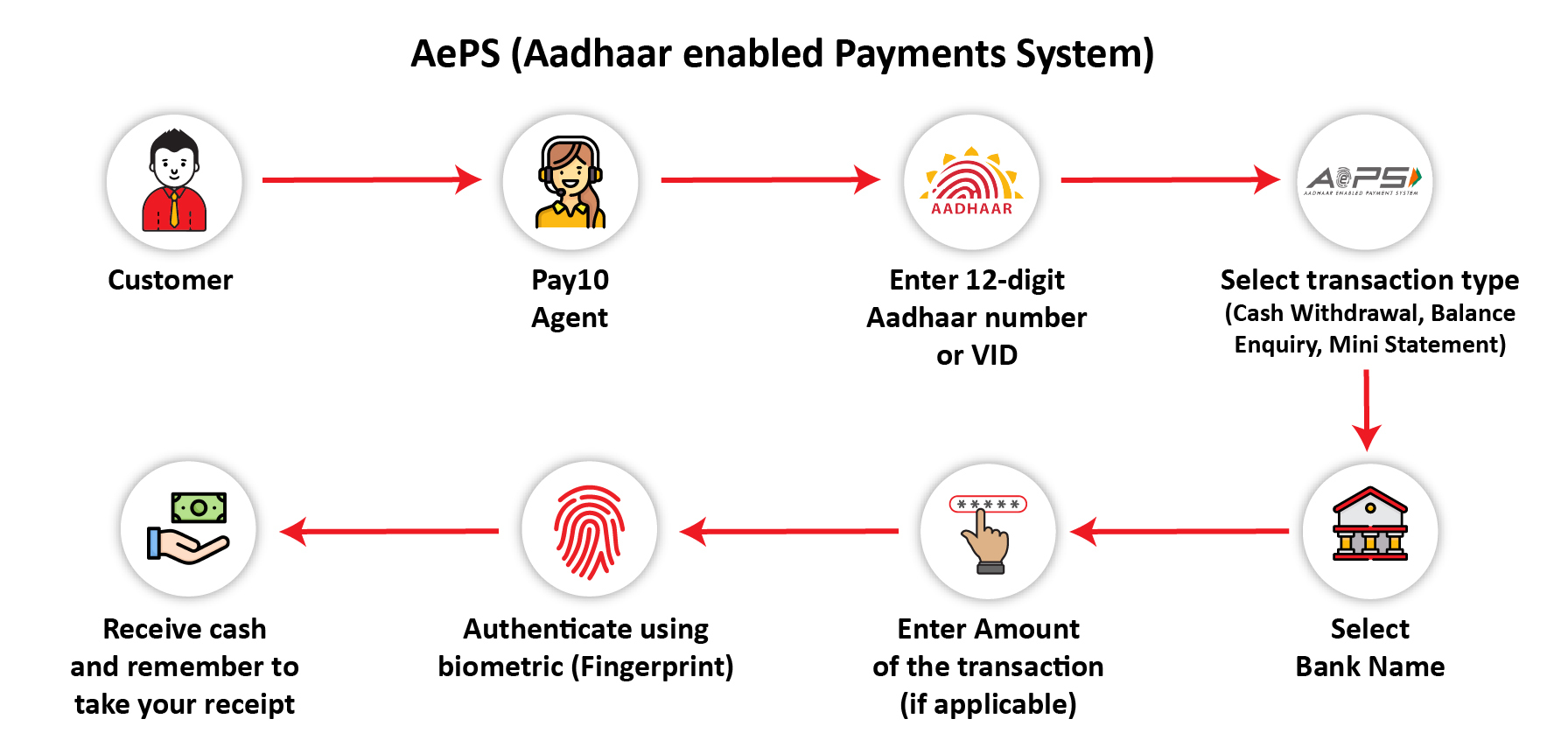

How to use AePS facility?

The remote location banking facility can be accessed at a Retail outlet/Kirana store or with a Business Correspondent who offers AePS services.

Are AePS transactions secure?

Pay10’s Agent Assisted Payment system is secured with Aadhaar masking and captures IP & location eliminating the risk of unauthorized access to the customer’s account.

According to Press Information Bureau, by the end of January 2023, cumulatively, 1,629.98 crore of last mile banking transactions have been made possible through AePS and the network of micro-ATMs in India. We at Pay10 envision an inclusive future as we collectively head towards a cashless economy fueled by digital advancements.

Pay10 offers innovative FinTech services that are designed to address the challenges faced by the rural demographic in India. You can also take a look at our ultra-efficient Payment Gateway with top-of-the-line security features, supporting several payment modes, and powers an analytical dashboard; Payment Links, Billing service, Reseller services, Payout services, and more.

Frequently Asked Questions

- 1. What is AePS?

- Aadhaar Enabled Payment Service (AePS), developed by National Payments Corporation of India (NPCI) aims to facilitate financial transaction using Aadhaar number.

- 2. What are the various uses of AePS?

- Balance enquiry

- Cash withdrawal

- Cash deposit

- Digital Payment

- Aadhaar to Aadhaar fund transfer

- Generating Mini Statement

- Cashless Merchant Payments with BHIM Aadhaar Pay

- Self Help Group (SHG) Banking

- 3. Are AePS transactions secure?

- Pay10’s Agent Assisted Payment system is secured with Aadhaar masking and captures IP & location eliminating the risk of unauthorized access to the customer’s account.