Payment Gateway API- Definition, Features, & Business Advantages

The digital future is here and now, with online payments becoming more reliable and efficient. The line between physical stores and digital warehouse blur to give the customer a seamless experience. Innovation only occurs with adversity, in case of digital payments, the pandemic was enough to fuel the growth of FinTech sector to facilitate contactless payments. How did India achieve this massive feat within such a brief period that global powers still endeavour to achieve?

According to Statista, in fiscal year 2022, almost 72 billion digital payments were recorded across India. The digital payments- scan & pay, single-click payment, and other innovative features are not products of mere 3 years of work, it has been a work-in-progress for the past 2 decades. The India Stack project has been an ambitious undertaking by the Indian government to securely obtain economic primitives to drive the digital economy at population scale. India Stack is the robust foundation that supports the FinTech industry at large.

So, let us begin with a basic understanding of APIs,’ India Stack, Features to look for in a Payment Gateway API and the advantages of using Payment Gateway API for your business.

What is API?

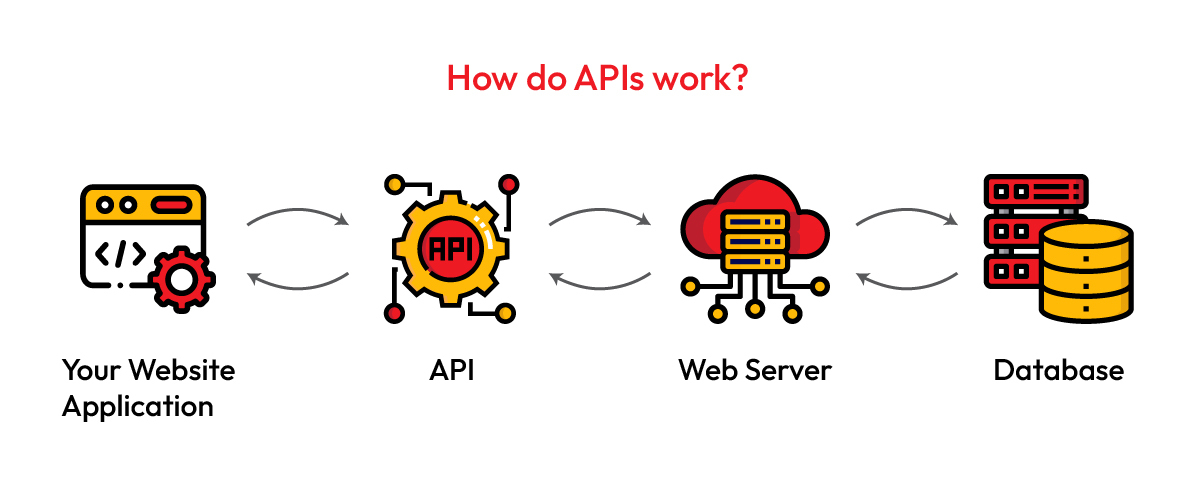

In simple terms, Application Programming Interface (API) is a software intermediary that allows two applications (apps) to talk to each other.

What is a Payment Gateway API?

API in Digital Payments connects the business’s check out page to Payment System availed and integrated by the business. For example: When a customer clicks on “Make Payment” button to purchase a product or service from an e-commerce site or app, the trigger makes a request to the “Pay10 API,” to enable secure payment processing by allowing both APIs’ to interact with each other.

There are several kinds of APIs’ currently available in the country for various applications and usage. One of the major resource platforms that enables the seamless functioning of Payment Gateways in India is India Stack.

What is India Stack?

India Stack is a set of open APIs and digital public goods that aim to unlock the economic primitives of identity, data, and payments at population scale. The gradual build of India Stack began with Aadhaar UID that digitized the identity of each individual citizen. The 4-tier build of India stack contains Authentication layer, Documentation Layer, Financial Transaction Layer, and Consent Layer.

How to choose the best Payment API?

1. Ease of use- APIs need to be simple and easily accessible. The structure of the API should provide a clear guidance for integration of the API.

2. Security- It is essential to provide impeccable security since payment APIs must protect customers’ sensitive data. Security features such as encryption and tokenization ensure that transactions remain secure and PCI DSS compliance offer world-class security to payment processing.

3. Documentation- State of the documentation offered by the Payment API is of vital importance. It must be clear and concise. Documentation is critical to the quality of your integration experience.

4. Omnichannel Capability- Choose an online payments API that offers versatile capabilities such as supporting multiple payment modes, device agnostic platform, analytical dashboard that helps identify and track transactions with ease, UI/UX features with ease-of-use.

5. Broad Functionality- Third-party payment partners help businesses accept payments, without setting up their own merchant account. It is easy to use third party APIs of Payment Service Providers that let you connect to a Payment Gateway. It also gives an opportunity to control refunds, establish recurring charges, in addition to regular payments.

What are the business advantages of using Payment Gateway API?

- Supports Multiple Payment Modes

- Omnichannel transaction

- Simplified Payment Processing

Businesses can offer a selection of payment modes that include credit card, debit card, internet banking, BHIM-UPI, Wallets, etc. This provides convenience that can appease a wider customer base from different demographics.

Businesses are no longer confined to stores and e-commerce. There are myriad payment options that straddles both. Payment Gateway API that integrates all the channels offer a seamless payment experience for the customer who can scroll through an app, place the product in an online cart, visit the store, and choose to order it on the website.

While the Payment Gateway API offers multitude of options for the customers to seamlessly skim through, it offers ease-of-use for businesses by integrating the same with all-in-one analytical dashboard that enables merchant to view the transactions on different payment modes, generates reports for any specified period with ease, contributing positively to improved business decisions.